Messaging and SMS

Vodafone's results are out today. One of the things that always surprises people from the tech industry is how much disclosure of operating metrics telcos typically give: Vodafone gives customers, minutes, data, smartphone penetration and a whole bunch of other stuff, broken out by market.

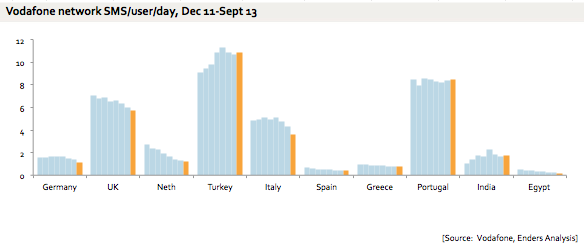

Amongst other things, this allows us to compare a bunch of markets for which national data is not always available (or available easily), on a more or less comparable basis. So, for example, one can look at the change in SMS use. This chart shows the change in messaging across the portfolio, on a messages per customer (and yes, that has caveats), indexed basis.

There's a wide range of different performance here, but the overall trend is pretty clear: SMS use is going down, with a few exceptions. The effects are strongest, unsurprisingly, in the Netherlands, Spain and Egypt, for varying reasons.

But the really interesting thing is to look at the absolutes.

There's very wide variation by country in how popular SMS is, and hence to where the effect is strongest. The places where SMS has collapsed most are in fact places where it was weak, relatively speaking, already.

This is partly about tariffs - different markets charge SMS very differently (in the UK most people get a big bundle of SMS included, for example, even on prepay). it's also about adoption cycles - Germany tends to be a late adopter in these sectors (or perhaps they just can't fit a sentence into 160 characters). And of course the profile of Vodafone portfolio customers is not completely uniform across markets. But it does give some explanation of why take-up of services such as WhatsApp and Line looks very different in different places, and has very variable operator reactions.